Alex Nolting

Prioritizing profit while planning public budgets has turned learning into a commodity, limiting potential in our society for the gain of a few in our society. While making education free might seem like an obvious fix, the greed of corporate America and its lobbyists has turned this conflict into a battle. Local governments make educational policies and, because of poor public funds, they have decided to limit public money going to school, forcing students to come up with the funds. The federal government does not prioritize education, leaving access up to the market, which turns students into consumers who must pay tuition in exchange to receive knowledge.

This situation has created an inequality of access to education, just like every resource that gets privatized. The ultimate objective of pleasing the students and their parents—conceived as consumers—has turned higher education into a bureaucratic nightmare that often just fulfills some shallow template of ‘job training,’ usually sending client off into the ‘work world’ with few critical thinking skills. Ongoing concerns about budgets and accountability have accelerated tendencies to model education after the values of the free market, prioritizing efficiency and customer satisfaction while treating education itself as a commercial transaction.

Debt has been a major mechanism of the neoliberal twist of capitalism’s history. Morality is directly linked to debt; when looked at simply, the way we talk about debt and credit shows that a loan is a bet on whether or not a person will make good on their word. It is a risk dependent on a person’s status in society. We invest the value we place on ourselves into that credit arrangement and into our relationship with debt. We measure how and who we are as a human being and then bet on our trustworthiness, our character. Our economic circumstances are out of our control, we are dependent on wages that are decided for us but with this moral component of debt it is often easy to place blame on ourselves. This is all to show how important debt has been for the development of neoliberalism and its pull-yourself-up mentality.

Debt as Social Control

With the rise of neoliberalism came stagnating wages for workers so the corporate class could profit in extremes never achieved before. Credit has made it so workers can still purchase goods while they do not make as much money, with the condition that they must pay back the owner of debt. The consequences of this shift have been profound, dramatically altering the social textures of everyday life. They have upended relationships between workers and employers, citizens and the state. They have shifted the place of the individual in society and encouraged the formation of new forms of consciousness and being in the world. “From college and retirement savings invested in equity mutual funds, to monthly credit card payments tied to the London Interbank Offered Rate (or LIBOR), to refinanced mortgages and lines of credit that allowed homeowners to extract cash from nominal changes in the value of their dwellings, Americans’ economic security was lashed to financial markets to an unprecedented degree. The crisis itself had been precipitated by an unlikely nationwide bubble in housing prices” (Davis, VI). Credit has changed our vocabulary which has, in turn, changed the way we think; the ‘human capital’ acquired from education is ‘investment security’ in our personal economic portfolios, it is no longer the foundation of democratic citizenship. “Student debt — the price one must pay in order to gain access to the possibility of upward mobility — is now one of the most risky investments in that portfolio” (Maisano).

In order to access an abundance of information, one must pay hefty prices for college tuitions. Students often do not even qualify for enough crushing loans to pay the full cost and as such, parents are increasingly taking out or co-signing loans on their children’s behalf and facing the same repayment problems as their offspring (Maisano 2012). When fully deconstructed, our access to knowledge is dependent on finance, which we must usually borrow from the corporate class. This is to basically say that if we want to be liberated by knowledge, we must indebt ourselves (and our families) at extremely high rates for the rest of our lives. This is the ultimate tool to compromise our will to do things. We do not own our labor, so we must work for bosses that pay us wages to use on necessities. This allows for a power dynamic that uses personal attacks to keep workers quiet: if you are in a large amount of debt that you cannot pay back, you are considered untrustworthy. We internalize this thinking and project it on fellow workers. This use of language has made even mentioning debt default a nasty thing. As the Debt Resister’s Operation Manual states, “Given this grim picture, some analysts argue that there is a student debt ‘bubble’ about to burst. Unlike the housing bubble, a mass devaluation of outstanding student loans might not be a bad thing for debtors. After all, the creditors can’t repossess your degree or your brain—or at least not yet! But there are harsh penalties for defaulting, making any bet that your debt-burden will someday be reduced a risky one at best” (Debt Resister’s Operations Manual).

The Story So Far

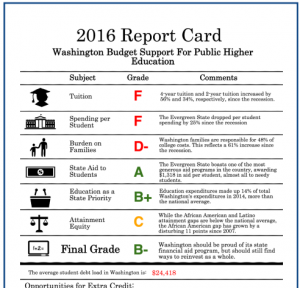

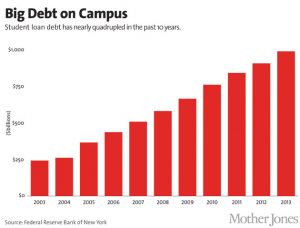

Many say that modern U.S. student loan practices started in the 1950s in the context of the race against the Soviet Union. In an attempt to get more people going to school to support the Cold War effort, the federal Perkins Loan Program was started but was relatively modest and developed in a time where explicit racism was allowed as criteria for distribution. This meant the money mostly went to white people for several decades (Taylor). Federal loans eventually expanded in 1965 with Stafford Student Loan Program but were still tainted with racial discrimination. By the 1970s (also around the birth of neoliberalism) the U.S. was in an economic crisis and states began a long-term disinvestment from public higher education, so money for schools had to come from raising student fees. This economic crisis also convinced the corporate class that wages should not go up. All of these austerity-type measures made it so people trying to go to school had to take out a loan. “In 1978, federal spending on student lending was $500 million. In fiscal year 2012, the federal government lent $115.6 billion in new student loans. Today, the average student graduates college or university with over $25,000 in educational loan debt” (Maisano). Students burdened with debt are left with no choice but to engage in activities that lessen their likelihood of earning degrees, such as working full-time while attending classes (Laitinen & Burd).

Looking at the history of student debt (and really, debt in general), we can see a pattern that truly exemplifies the “wreckage of capitalism.” Almost every social and economic problem in the United States is related to bankruptcy courts. Whether it’s a lost job, health insurance, income issues, or divorce, bankruptcy court has become a place in which we deal with the exploitation of our finances (Maisano). Student debt falls right into the middle of bankruptcy in the U.S. because in 1976, the Congress-appointed Bankruptcy Act Commission ruled that student debt could not be discharged, unlike other types of consumer debt that the Commission decided should be. This ruling came out of concerns that borrowers would finance their education through easily accessible loans and declare bankruptcy after graduating. There was very little evidence to prove this, but this was in the time of hating on perceived ‘entitlements’ that were seen as the detriment to society and so the Commission created the Bankruptcy Reform Act that allowed student debt discharge only if the debt would bring “undue hardships” to the debtor (Bankruptcy Reform Act of 1978). Issues come from vague ruling like this, especially since the Commission did not define “undue hardships” or recommend any type of standard.

Vague rulings left local bankruptcy courts to figure out how to measure “undue hardship.” The “Brunner Test” is the most commonly used measure, established in 1985 by the U.S. District Court for the Southern District of New York. First, “debtors must show that they cannot maintain a ‘minimal’ standard of living if forced to repay the loans. Second, the available evidence must show that this sorry state of affairs will likely persist over the course of the repayment period. Third, debtors have to show that they have made a good faith effort to repay the loan” (In Re Brunner). Congress was under corporate pressure to rule in the favor of business, which has led to bankruptcy judges having more or less complete freedom to deal with debt on a case-by-case basis. Having the government involved in issues of debt was seen as Congress having too much power in a time where neoliberal policies were being expanded upon. “As representatives of the judicial branch of a capitalist state, it should come as little surprise that these judges have, more often than not, privileged the claims of the creditor over those of the debtor in their rulings” (Maisano).

Michel Foucault writes about neoliberal governmentality and how it seeks to condition workers for the “enterprise society.” This conditioning does not show itself in the form of pure top-down domination. Foucault argues “the genius of this form of social control is that it elicits the active participation of the population in the construction of its own discipline. By bringing ever-widening circles of the population into the orbit of finance capital, it imbues the process of financialization with a spirit that accords with democratic norms of mass participation and equal opportunity” (Foucault, Maisano). This conditioning for the ‘enterprise society’ is exemplified in the way workers internalize their economic struggle as their own fault for not being a hard-enough worker. This logic keeps workers from questioning the structure of our economy as a whole; we just need to pull ourselves up.

The College Experience

The logic against publicly funding schools is the same anti-Communist rhetoric that has been around since the 1940s, when the school lunch program was considered ‘evil’ (Congressional Record). In reference to Foucault’s idea of social conditioning, the language has evolved to be much less explicit. Instead of anti-Communist, we say “pro-business” or “deregulation.” We do not reap any benefit from a large portion of the revenue in society but are indebted to the owners of that money so when we talk about changing the system that is debt is leveraged against us in personal attacks. Imposing this logic has had terrible effects on the quality of education, especially causing students to focus on finances rather than academics. “By integrating higher education into the circuits of financial capitalism, the state encourages debtors to look to the market for self-improvement and personal security. Much like the subprime mortgage borrower or the worker with a 401(k) plan, the indebted student is taught to view access to credit and the financial markets as the golden ticket to prosperity and security” (Davis, Maisano).

Debt burdens incentivize ‘entrepreneurial’ behavior for people to get out of debt. It has been fascinating to see Communism and Marxist theory perceived as ‘of the bourgeois’ and only for those in college to learn (accessible to the rich). Through the commodification of knowledge under a complex system of debt, borrowers are leveraged to adopt capitalist thinking but with no real promise of getting a job. Investing in college education has become extremely risky. “Judges have directed dance teachers to seek better-paying work in other, often unrelated fields; reproached workers for leaving higher-paying jobs for lower-paying ones, whatever the reason; and, in one case, advised the pastor of a small, financially insecure church to close it and do something more profitable with his time. Unsurprisingly, many student loan debtors desperate enough to seek relief through the courts work in public sector professions” (Maisano). Cases like this happen frequently and are examples of how work for the public, work for solidarity, and work for compassion are completely devalued by our society. Risky investments made in education will be paid off much more easily by work that supports financialization.

Results from a study on undue hardship proceedings by Michelle Lacey and Rafael Pardo clearly show that disproportionate number of plaintiffs worked in education, training, and library occupations. Their findings raise “serious concern regarding access to justice and thus challenge long-standing assumptions regarding the propriety of discharge litigation for relief from student loans in a bankruptcy system designed to provide a fresh start for debtors” (Lacey & Pardo). Attempting to go to school for public work could be an extreme detriment to your economic situation.

What Do We Do?

The Debt Resister’s Operations Manual is a book written by members of the Occupy movement and Strike Debt organization that provides extremely accessible ideas about debt. In chapter four, specifically about student debt, they write about how debtors have been “coming out” and showing other people how we are all affected by debt. What this has shown is that while the single largest debt loads are racked up by students from middle-income families seeking a private university degree, the overall impact of debt is magnified among low-income families.

“Of those who have earned bachelor’s degrees, about 81% of Black students and 67% of Latino/a students leave school with debt, compared to 64% of White students. As a result of the home equity losses suffered since 2008, Black people lost a huge portion of the economic gains they had made in the post–civil rights era. Reflecting those losses, Black students have had to borrow more for education than Whites, and the racial inequity of the employment landscape means they are twice as likely to be unemployed on graduation. Also, students of color are much more likely to enroll in for-profit schools, which have high non-completion rates and account for nearly half of student loan defaults” (Debt Resister’s Operations Manual).

The manual proposes ways debt default can be worked with but acknowledges that many of these ‘solutions’ just hold off immediate foreclosure. For individuals, it is suggested that when a collection agency contacts you, act immediately. By writing a letter to contest your debt upon collection agency contact, the agency legally has to provide a report of all money owed to the creditor (a paper trail that can take quite a while to gather and may not be accurate). Debt collectors thrive off of those who do not know the rules and admit to debt that their might not be proof for. If you take these steps, “there is a likely chance you may not hear back. Remember, the collection agency is most likely to pursue the people they think are most likely to pay” (Debt Resister’s Operations Manual).

Collective action is proposed in the manual as well; “A wave of governments under the sway of neoliberal ideologues have been doing their best to undermine once well-funded university systems in hopes of imposing U.S.-style debt-financing on their students. But the immense suffering that system has created is no secret, and students across the globe have begun to draw lines in the sand, staging massive protests, strikes, and direct actions to resist” (Debt Resister’s Operations Manual). In Chile, hundreds of thousands of students protested unfair access to education. These protests happened in Quebec and Britain as well, showing the power that collective protest has to undermine the financial sector. They depend on us for the debt, but if we collectively do not pay they have nothing they can do. The manual also warns against “pro-capitalist reform proposals” that push for partial loan forgiveness that do not actually address the root of the issue. Demanding accountability from the financial administration of our education centers is a big first step against a power that expects you to submit to it. We in the U.S. are going to have to break down some pretty extreme ideas we have internalized about debt to start making those demands.

Sources

Albo, G., Panitch, L., & Gindin, S. (2010). In and Out of Crisis: the Global Financial Meltdown and Left Alternatives. Chicago: PM Press.

Bankruptcy Reform Act of 1978, 11 U.S.C. §§ 95-598 (1978)

Center for College Affordability and Productivity. (2014). Dollars, Sense, and Nonsense: The Harmful Effects of Federal Student Aid. Washington, D.C: CCAP Staff.

Collinge, A. (2009). The Student Loan Scam: The Most Oppressive Debt in U.S. History, and How We Can Fight Back. Boston, MA: Beacon Press.

Congressional Record,79th Cong, 2nd session,1946, 92, pt.3.

Davis, G. F. (2011). Managed By The Markets: How Finance Reshaped America. Oxford: Oxford University Press.

Debt Resister’s Operation’s Manual. (2014, April). Chapter Four. StrikeDebt.

Foucault, M., & Senellart, M. (2011). The Birth of Biopolitics Lectures at the College de France, 1978-1979. New York: Palgrave Macmillan.

Laitinen, A., Delisle, J., Fishman, R., McCan, C., Carey, K., Holt, A., & Burd, S. (2013, January 29). Rebalancing Resources and Incentives in Federal Student Aid. New America.

Maisano, C. (2012, December 12). The Soul of Student Debt. Jacobin.

Pardo, Rafael I. and Lacey, Michelle R., The Real Student-Loan Scandal: Undue Hardship Discharge Litigation (October 24, 2008). American Bankruptcy Law Journal, Vol. 83, No. 1, 2009; 3rd Annual Conference on Empirical Legal Studies Paper. Available at SSRN: https://ssrn.com/abstract=1121226

U.S. Department of Education (2015, November 06). Perkins Loans. StudentAid.ed.

Schoof, R. (2013, May 29). Public Colleges are Often No Bargain for the Poor. McClatchy DC.

U.S. District Court for the Southern District of New York – 46 B.R. 752 (S.D.N.Y. 1985 February 21).

Taylor, K. (2016). From #BlackLivesMatter to Black Liberation. Chicago, IL: Haymarket Books.